Data Wednesday – AI Impact in Retail Segments – Not All Are Created Equal

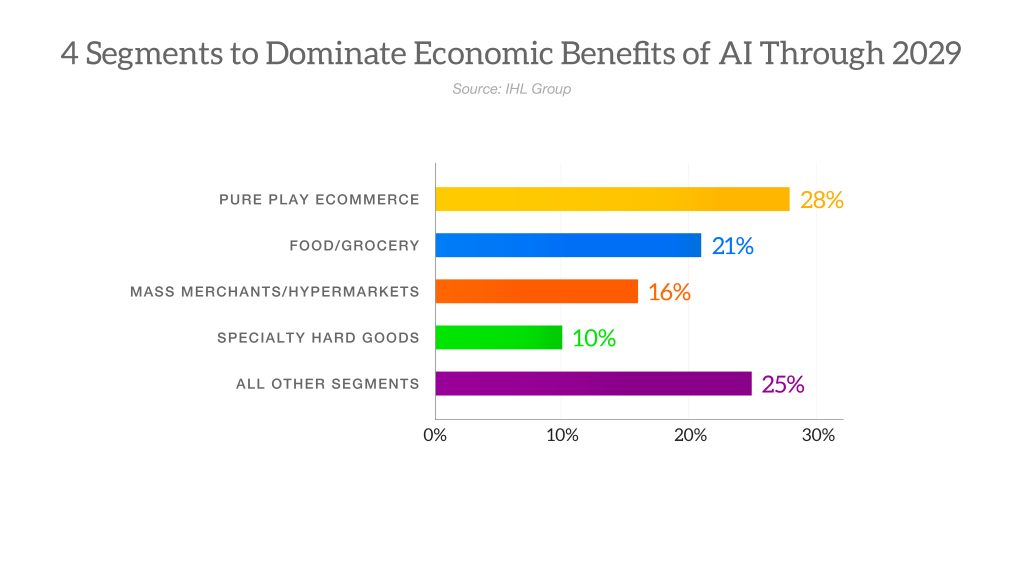

When it comes to the AI impact in retail segments, not all are considered equal. The economic benefits of AI/ML and Generative AI will be unequally distributed according to the IHL Retail’s AI Revolution Forecast. While the model reviewed 12 different retail and hospitality segments, there are 4 that will dominate the benefits in the next several years due to inherent benefits.

Pure Play Ecommerce

The first segment is Pure Play ecommerce companies who we believe will see up to $2.6 trillion or 28% of all the economic benefit. Our reasoning here is scale benefits as well as generally having better data on customers that is also cleaner by nature than most multi-channel retailers. There are simply fewer systems to clean data, and it is easier to get to a single version of the truth on that data as a result. It is not a surprise that these companies are generally much further ahead already in using traditional AI/ML, automated warehouses, delivery robots, etc. With the addition of Generative AI on top of these improvements, they simply have a first mover advantage over most others.

Grocery

Our second segment seeing the biggest impacts from AI will be the Food/Grocery segment with potential economic benefits of up to $1.9 trillion over the next several years or just under 21% of the total. Here, the issue is just the total size of the segment combined with rapid growth from being “essential” during the pandemic, leading to outsized growth and more funds to begin investing. From a revenue standpoint, this segment dwarfs all others because people have to eat. One specific area showing great improvements already is in Computer Aided Ordering solutions leveraging AI. Some retailers are seeing between 3-9% in sales gains per category when utilized. This is disrupting vendor managed categories and direct store deliveries, leading to greater profits.

Supercenters/Hypermarkets

Next, we project Supercenters, Warehouse Clubs, Hypermarkets and Mass Merchants will enjoy up to $1.5 trillion in potential economic benefit from AI in the next 7 years, or a little over 16% of total benefit. More than any other segments, these benefited from the transfer of wealth during the pandemic. Due to the scale of each company as well, they have been one of the fastest growing and invested the most of any multichannel retail segments in AI tools, data scientists, and others. For instance, it was rumored that leading up to the pandemic, Walmart was hiring more data scientists than even Google. Those investments as well as scale provides huge advantages towards AI economic benefits that other segments do not enjoy.

DIY/Home Improvement

The last segment we wish to highlight is Home Improvement, which is a considerable portion of the total Specialty Hard Goods which represents a little over 10% of the total economic benefits. The Home Improvement category is the only Specialty Hard Goods segment to see growth both before the pandemic as well as throughout the recovery. This re-homing and virtual work provided huge profits and reservoirs from which to do the hard work related to the data cleansing, so they are at a big advantage.

This is not to say that clothing or restaurants are not going to see huge benefits as well, they simply have additional challenges. The lack of consistent sizing for clothing is particularly devastating to that segment. While major strides can be made with Tru-Fit type technologies to reduce returns, as well as tremendous gains in the SG&A part of the companies, the challenges of sizing and the added complexity of SKU-based scanning rather than UPC scanning just adds much greater complexity and harder to gain the same efficiencies that the other segments share.

IHL’s complete forecast can be found here.

A free top level research study can be viewed here.

If you have questions on either you can reach out to me here on LinkedIn or via email at ai@ihlservices.com