Retail Returns: A Double-Edged Sword

Retail Returns

Retail returns continue to be a challenge for the industry, and they require a system of reverse logistics. As e-commerce continues to rise, so too does the volume of returned merchandise. But retail returns are a double-edged sword for retailers, offering an opportunity for customer satisfaction but also presenting significant operational and financial challenges.

It’s Not a Simple Problem

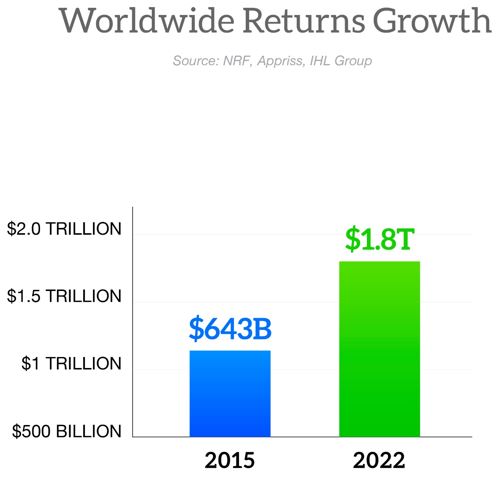

Returns are a global issue, impacting retailers of all sizes and across various sectors. In 2015, worldwide returns amounted to $643 Billion. Fast forward to 2022, and that number had grown to a staggering $1.8 Trillion. The growth of returns is so pervasive that 100% of retailers report that return rates are outpacing revenue growth. This trend poses a significant challenge for retailers, impacting margins, operations, and customer satisfaction.

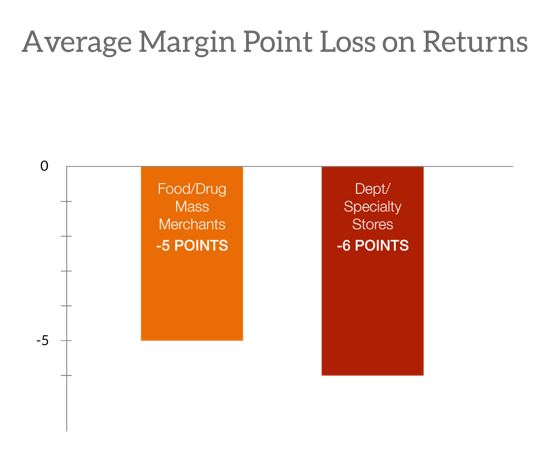

Margins Lost: What Can Be Regained?

Returns can significantly erode a retailer’s profit margins. The cost of processing, restocking, and disposing of returned items adds up quickly, impacting the bottom line. However, there is hope for retailers looking to recapture lost margins. Retailers can recapture up to 50% of the margin loss from returns by optimizing return processes and implementing a complete reverse logistics process.

Return Fraud

Return fraud is a significant problem in the retail industry. Fraudulent activities, such as wardrobing (which can be just as significant a problem for DIY as it is for softgoods retailers) and counterfeit returns, range from 8-11% of total returns, depending on the retail or hospitality segment. These fraudulent returns further compound the returns challenge, increasing costs and harming margins.

Sustainability

Sustainability is becoming an increasing priority for consumers, and retailers must consider the environmental impact of returns. Over $52 Billion in apparel is returned annually (more than the combined revenues of Kohl’s and Macy’s), much of which ends up in landfills. However, 68% of consumers care about sustainability, and only 35% are knowledgeable about the environmental impact of returns. Retailers therefore have an opportunity to market their sustainability practices, as 70% of customers appreciate these efforts.

Preventing Returns

Preventing returns at the source is a critical strategy for retailers. More than 60% of returns are caused by the merchant, often due to inaccurate product descriptions or incorrect orders. Basically, retailers must focus on providing accurate product information, improving order accuracy, and setting realistic customer expectations to reduce the likelihood of returns.

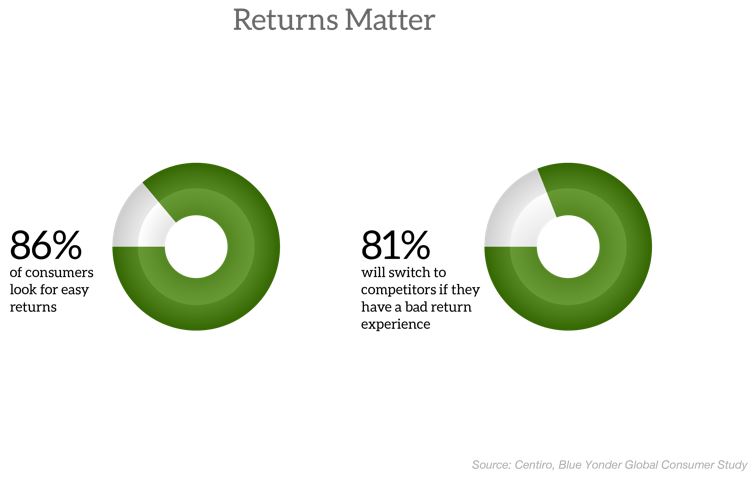

Returns Policies

Return policies play a crucial role in the customer experience and return rates. A staggering 86% of consumers look for easy returns, and 81% would switch to a competitor following a bad return experience. Retailers must implement clear, customer-friendly return policies that balance customer satisfaction with return minimization.

Controlling the Merchandise

Upon receiving a return, retailers should have systems in place to inspect and categorize the merchandise. Depending on the condition, returned items can be restocked, refurbished, donated, or disposed of. Efficiently managing returned merchandise can help retailers minimize losses and optimize inventory levels.

Optimizing Processes

Optimizing return processes can reduce the cost and complexity of handling returns. For example, automation, return authorization, and return tracking are just a few ways retailers can streamline return operations, improving efficiency and enhancing the customer experience.

Pre-planning Online Returns

Online returns are a particular challenge, as 90% of women’s dresses purchased online are returned. Retailers must pre-plan online returns by offering return labels, providing clear return instructions, and ensuring a seamless return process for customers.

Collection Points and Carrier Networks

Partnering with collection points and carrier networks can facilitate returns and reduce the associated costs. Self-service returns kiosks, for example, can cut in-store, returns-related labor costs by 94%. By offering convenient return options, retailers can encourage prompt returns and minimize processing costs.

Performance Analytics

Using analytics to track return performance and identify trends can provide valuable insights for retailers. Analyzing return data can help retailers understand the causes of returns, assess the effectiveness of return policies, and measure the efficiency of return processes.

Prioritizing Solutions / Increasing Margins

Retailers should prioritize solutions that have the greatest impact on return rates and margins. By focusing on preventing returns, optimizing return processes, and combating return fraud, retailers can increase their margins and improve their bottom line.

Next Steps

The returns challenge is ongoing, and retailers must continuously evaluate and refine their return strategies. By implementing effective return policies, optimizing return processes, and using technology to manage returns, retailers can navigate the return challenge and achieve long-term success. For a deeper dive into retail returns, take a look at our Retail Gets Religion on Returns page for our current research report, a recording of our webinar, and the associated slide deck. You can find our previous webinar titled The Coming Retail Returns Tsunami.