Retail Order Management Market Share: Tracking the Leaders in this Explosive Growth Market

IHL Group is pleased to announce the publication of our Worldwide Order Management report. This is the 6th publication which began in 2016. The goal of this report is to provide the retail community with the most detailed and complete picture possible of the order management landscape. We do this as a tool assisting retailers in their vendor selection as well as giving vendors the ability to somewhat benchmark their capability.

For retailers reviewing this report, most of the charts and tables are meant to highlight specific components of functionality that we deem to be critical in our review of the competitive landscape. Should you have additional questions, we’re quite happy to schedule a call to review any aspect of the report, the process, or further vendor observations beyond what is summarized to help you further understand our observations.

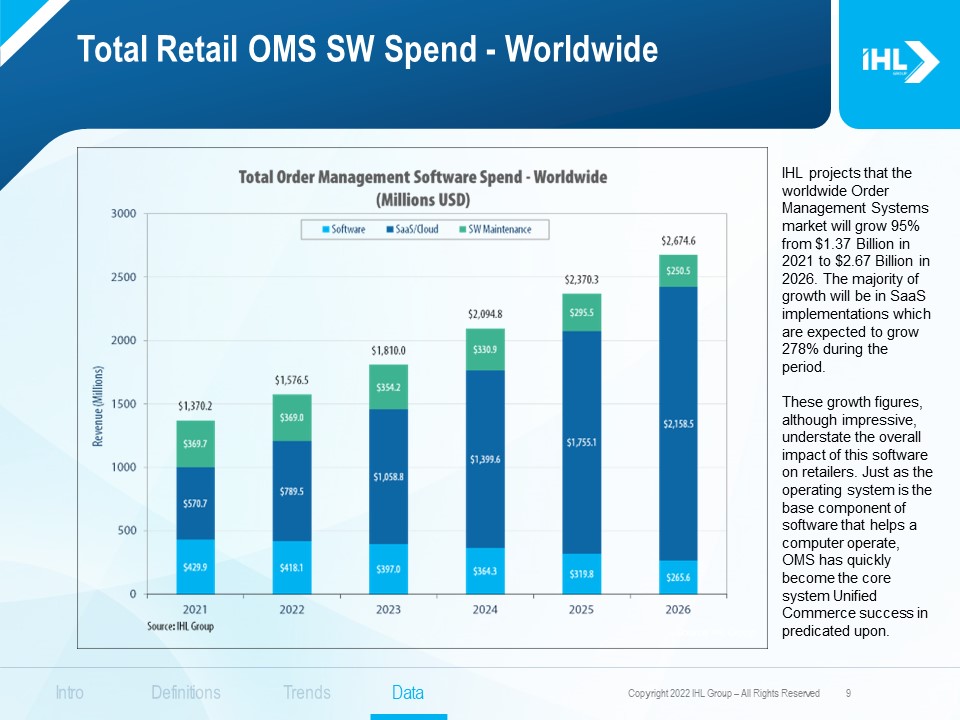

The influence and impact of OMS is broadening as more and more customer journeys touch order management in some way. This is a worldwide trend. COVID-19 continues to act as an accelerant in the transition from in-store to online buying, driving a drastic mix in customer journeys. From our Worldview IT Sizing, we project OMS SaaS revenue to grow 278% from $570.7 Million in 2021 to $2.16 Billion in 2026. SaaS continues to be the delivery method of choice, during this period, we project packaged software and software maintenance to decrease by 36%.

Our evaluation process largely rests on not only where the solution is being used, but also a deep dive into functionality. The foundation of our positioning analysis uses over 1,600 known installs from our Sophia competitive intelligence tool, meaning instances where we know Vendor A’s is supplying OMS software to Retailer B. This yields a statistically significant view of the overall OMS market. We believe at a foundational, the market itself is one of the best measures for market needs.

The complement the evaluation process with a 75-question deep dive survey, a vendor/solution briefing at their discretion, and lots of back and forth to clarify and fact check the final report. Our process is open to any vendor servicing retailers with over $20 million in revenue. In the report we have included every vendor that agreed to participate in the evaluation process.

Key areas of evaluation included the following areas:

- Advanced Functionality

- AI/ML

- Architecture

- B2B Functionality

- Core Functionality

- Installation/Integration

- In-Store/Fulfillment

- Internationalization

- Optimization

- Reporting

- Roadmap

- Unified Commerce

This report cannot effectively be done in a vacuum, and we would like to thank the following vendors for their willingness to support our research process: Aptos Retail, Fluent Commerce, Fujitsu, IBM, KBRW, Körber/enVista, Manhattan Associates, OneStock, OneView Commerce, Oracle, Orckestra, Salesforce, Softeon, Symphony RetailAI, and Tecsys.

More information about IHL Group’s OMS report can be found here.